There cannot be a better balm to your scars than victory. The Indian cricket team gave 140 crore Indians just that balm on Saturday night and into the early hours of Sunday after winning the ICC World T20 for the first time in 17 years. It is a different feeling to be called "World Champions."

What has also acted like a champion through the June series is the Nifty. From slipping below 22,000 on the Lok Sabha Election Results day on June 4, the index has staged a bounce back like no other, eventually ending the series above the mark of 24,000. But the question now is, has the Nifty run its course for the time being?

For the entire third week of June and the better part of last week, it was the banks and index heavyweights like Reliance Industries that continued to lead the market higher. But the former has started to see some signs of exhaustion emerge at higher levels.

The banking index was a non-participant during the Nifty's upmove on Thursday and led the index lower on Friday, despite support from other constituents like Reliance. And with the index having moved 7,000 points from the lows of June 4, the question to be asked is, will the Nifty Bank now trigger a correction in the Nifty considering the swift run up seen by both the indices over the last 15-20 sessions?

Historically, July has been a good series for the Nifty, with gains ranging between 4% and 7% in three out of the last four years. But this series comes with multiple triggers. Global cues of course, are one, but domestic cues are aplenty as well.

Earnings season begins by the second week of July but before that, companies will begin announcing their business updates for the quarter, which will give an indication on how the quarter has been for India Inc. The Union Budget and the progress of the monsoon in the country will also be market moving factors in the month of July.

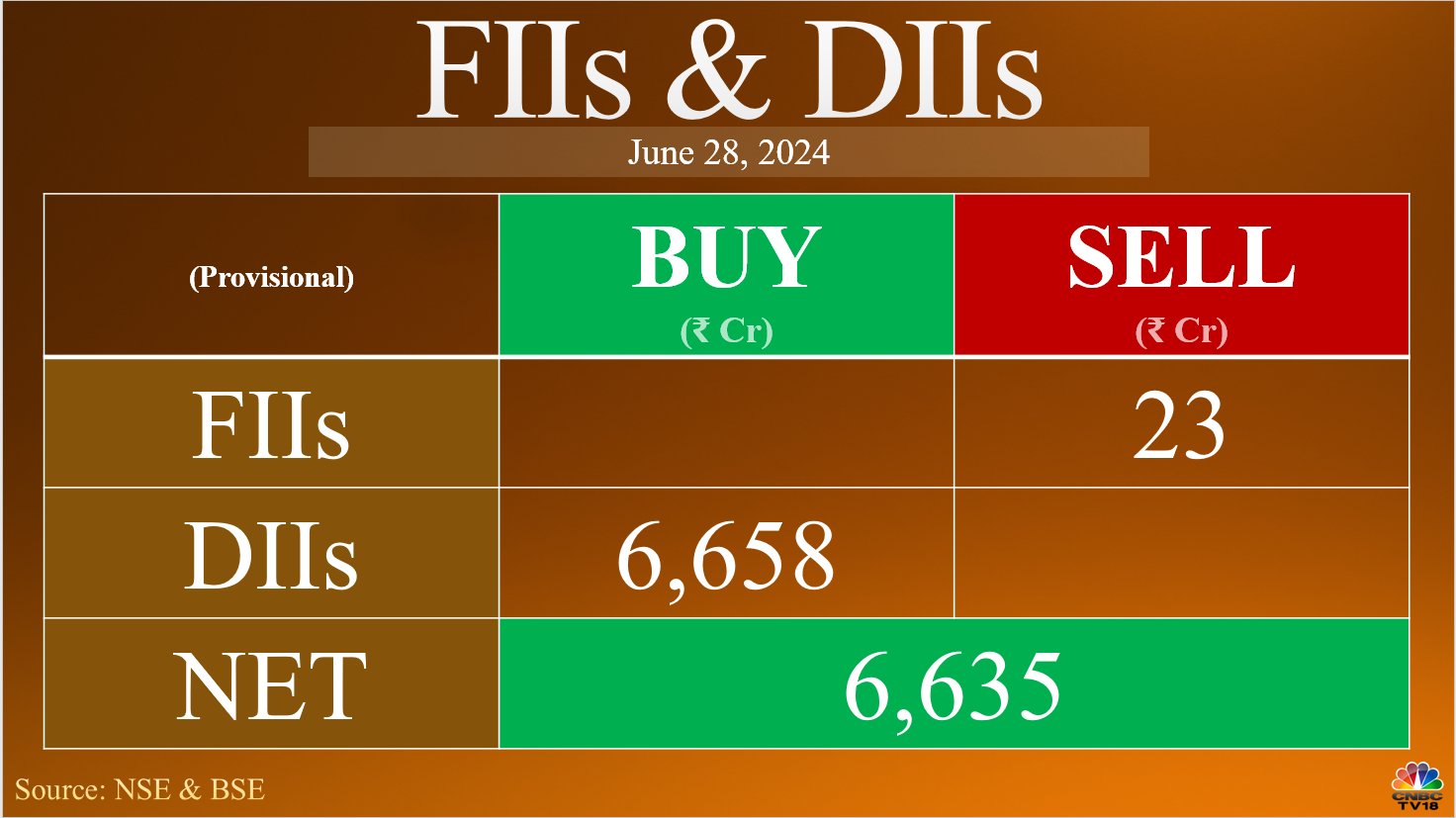

Foreign investors were sellers in small quantity on Friday, while domestic institutions were heavy buyers.

Technically, the uptrend remains intact but the RSI on the hourly chart is indicating the possibility of a pullback move or a consolidation within an uptrend in the Nifty, said Ruchit Jain of 5paisa.com. In case of a pullback, 23,800 or 23,600 will act as supports for the Nifty. The positional support has also shifted higher to 23,400. On the upside, 24,200 and 24,600 will be barriers for the index. He advises a buy-on-dips approach on the index.

Rajesh Bhosale of Angel One said that while taking contra-bets and shorting the market is not advised, taking some profits is prudent at higher levels as either a price or time correction can be anticipated. 24,200 - 24,250 is an immediate resistance for the Nifty, while 23,850 and 23,650 on the downside can be key support levels.

HDFC Securities' Nagaraj Shetti too sees the Nifty facing hurdles between 24,000 and 24,100, even as the near-term uptrend remains intact. He advises a pullback to be used as a buying opportunity with immediate support at levels of 23,800.

The Nifty Bank has gained for seven weeks in a row. It may also be due to this, that some bit of exhaustion is beginning to creep in at higher levels for the index. The Nifty Bank fell nearly 500 points on Friday, and struggled to close above 53,000 yet again. Friday's high was lower than the one it made on Thursday. Yet, the index was up 1.3% for the week.

Kunal Shah of LKP Securities also termed Friday's move as the first meaningful correction after a non-stop rally for the Nifty Bank. He said that there needs to be some follow-on selling for the index to fall further, else it may get stuck in a consolidation range. Immediate support is at 52,000, while 52,700 - 53,000 is a barrier for the index.The Nifty Bank chart displays an evening star pattern, which is bearish and the daily RSI at 65 is shifting down towards its average line, said Om Mehra of SAMCO Securities. The resistance for the index remains near 52,900 - 53,050 range, while the support is at 51,700. He advises a "sell-on-rise" strategy on the index, till it decisively moves above 53,000.

Asit C Mehta Investment Interrmediates' Hrishikesh Yedve also believes that the Nifty Bank has formed a bearish candle near the trendline resistance and for the short-term 53,200 will act as a hurdle. Only on sustaining above 53,200, can the index see a rally towards 54,000.

What Are The F&O Cues Indicating?

Nifty 50's July futures added 1.7% or 2.3 lakh shares in Open Interest on Friday. They are trading at a premium of 121.65 points. On the other hand, Nifty Bank's July futures added 0.8% or 19,350 shares in Open Interest on Friday. Nifty 50's Put-Call Ratio is at 1.2 from 1.49 earlier.

India Cements and Indus Towers have entered the F&O ban.

Nifty 50 on the Call side for July 4 expiry:

For this Thursday's weekly options expiry, the Nifty 50 Call strikes between 24,200 and 25,000 have seen Open Interest addition.

Nifty 50 on the Put side for July 4 expiry:

On the Put side, the Nifty 50 strikes between 23,500 and 24,150 have seen Open Interest addition for this Thursday's weekly expiry.

These stocks added fresh long positions on Friday, meaning an increase in both price and Open Interest:

StockPrice ChangeOI ChangeGNFC5.38%79.75%India Cements2.22%60.95%PNB2.77%28.40%SAIL4.05%23.77%Chambal Fertilisers1.51%17.71%

These stocks added fresh short positions on Friday, meaning a decline in price but an increase in Open Interest:

StockPrice ChangeOI ChangePolycab-3.73%85.53%JK Cement-2.23%13.25%Coforge-1.54%12.75%City Union Bank-0.15%11.61%Crompton-2.98%9.04%

Short covering was seen in these stocks on Friday, meaning an increase in price but a decline in Open Interest:

StockPrice ChangeOI ChangeTata Motors1.78%-7.38%Grasim1.16%-5.53%Reliance Industries2.55%-5.33%IndiaMART1.72%-4.79%IPCA Labs3.36%-3.71%

These are the stocks to watch out for ahead of Monday's trading session:

- Auto Stocks: To report sales figures for the month of June.

- Vodafone Idea: Increases tariffs for its pre-paid and post-paid customers from July 4, 2024. Tariffs hiked across pre-paid and post-paid plans by 10% to 21%. To invest in enhancing 4G experience and launch 5G services over the next few quarters.

- Cochin Shipyard: Udupi Cochin Shipyard Ltd., a wholly-owned subsidiary has signed a contract with Wilson ASA, Norway for the design and construction of four 6,300 TDW Dry Cargo Vessels. An Agreement has also been signed for four additional vessels of the same kind, which will be formally contracted by September 19 this year. The overall cost of the eight vessels is said to be ₹1,100 crore and Cochin Shipyard plans to execute this order by September 2028.

- Godrej Properties: Acquires leasehold rights for 11 acre land parcel in Pune with a revenue potential of ₹1,800 crore. The development on this land will comprise of Group housing and high street retail. The company has also acquired nearly 7 acre of land in Bengaluru with an estimated revenue potential of nearly ₹1,200 crore.

- Zydus Life: Announces licensing agreement with Dr. Reddy's Laboratories for co-marketing of Pertzumab Biosimilar, a critical treatment for breast cancer patients in India. The product will be marketed by Zydus under the brand name "Sigrima", while DRL will market it under the brand name "Womab." Zydus will receive upfront licensing income and is eligible to receive milestone income based on achievement of pre-defined milestones.

- IREDA: Loan sanctions up 5x year-on-year in the June quarter to ₹9,136 crore. Disbursement of loans grew by 67.6% from last year to ₹5,320 crore. At the end of the June quarter, IREDA's loan book stood at ₹63,150 crore, up 33.77%.

- Orchid Pharma: Partners with Cipla to launch antibiotic Cefepime-Enmetazobactam in India. The drug has been approved for the treatment of complicated Urinary Tract Infections, Hospital-Acquired Pneumonia and Ventilator-Associated Pneumonia Indications. The partnership with Cipla is to ensure widespread and rapid distribution of this antibiotic combination across India.

- JSW Energy: Arm JSW Neo Energy gets an LoA for 300 MW wind-solar hybrid capacity from SJVN.

- TVS Motor: Invests ₹282.67 crore in TVS Credit Services via subscribing 68.94 lakh equity shares. With this, TVS Motors' shareholding in TVS Credit Services increases from 80.53% to 80.69%.

- Ajanta Pharma: Promoter creates pledge on 4.5 lakh shares of the company for refinancing.

- Bank of Baroda: To consider capital raising plan for financial year 2025 by raising funds on July 5. To raise funds via Additional Tier-1 and Tier-2 debt capital instruments with an interchangeability option.

- UltraTech Cement: Commissions an additional 3.35 MTPA Clinker and 1.8 MTPA grinding capacity at its existing unit at Tadipatri in Andhra Pradesh.

- GAIL: Advances its net zero target for Scope-1 and Scope-2 GHG Emissions to 2035 from 2040.

- Tata Steel: To convert debt instruments worth $565 million in T Steel Holdings into equity shares in financial year 2025. Post this conversion, T Steel Holdings will continue to be a wholly-owned subsidiary of the company.

- Neogen Chemicals: Promoter divests nearly 5.7% ownership in the company via block deals. SBI Mutual Fund and White Oak Group were buyers in that transaction.

- Navin Fluorine: Board approves fund raise to the tune of ₹750 crore via QIP and other modes.

Source link