)

The Tokyo-based company targets 10,000 new hires globally over the next five years. Image: Bloomberg

Tokyo Electron Ltd. seeks to build a team of chip engineers in India to better ride the Modi government’s push for more semiconductor manufacturing in the world’s most populous country.

Japan’s biggest chip equipment maker plans to hire and train local engineers in or around 2026, with their first task to provide technical services to Tata Electronics Pvt, Chief Executive Officer Toshiki Kawai said. Robotics will play a growing role and local staff will be provided with in-person and remote support from Japan, he added, declining to specify how many people the company would need to hire.

India is amping up efforts to attract international electronics companies and chipmakers to set up facilities within its borders, under a plan by the Narendra Modi administration to close the tech gap with advanced economies. Apple Inc. is accelerating its production and sales of iPhones in the country, while Tata Group and others are investing billions of dollars in semiconductor fabrication plants. The government is providing incentives to support those ventures, which will need machinery and knowhow from companies like Tokyo Electron.

Shares of the company, which traded Friday morning without the right to receive its next dividend, rose around 6% after stripping out the impact of the payout.

The Tokyo-based company targets 10,000 new hires globally over the next five years, as more countries race to build chips at home. Tokyo Electron supplies gear to Taiwan Semiconductor Manufacturing Co., Samsung Electronics Co., SK Hynix Inc. and Intel Corp., and its forecast for the business year to March points to record revenue and operating profit. It also expects overall chip demand to double by 2030, boosted by artificial intelligence, autonomous cars and a push toward energy efficiency and decarbonization.

That’s even as the US pressures Japan to further tighten restrictions on exports of advanced chipmaking gear to China, part of an extended effort to curb its technological progress. US officials have sought to limit Tokyo Electron’s ability to service some of its machines in China and have talked of invoking the foreign direct product rule, or FDPR, which allows Washington to control sales of products made anywhere in the world if they use even a small amount of American technology.

Such moves won’t affect global appetite for chipmaking machines, 61-year-old Kawai said. “The importance of semiconductors remains unchanged,” he said in an interview. “There will always be investment somewhere.”

Tokyo Electron said earlier this month it will help train Tata Electronics’ workforce on chipmaking equipment and support its research and development. Modi’s administration has so far approved more than $15 billion worth of semiconductor investments, including US memory maker Micron Technology Inc.’s plan for a $2.75 billion assembly facility. Israel’s Tower Semiconductor Ltd. is also seeking to partner with billionaire Gautam Adani on a $10 billion fabrication plant in western India.

Sales to China, which surged to around 50% of Tokyo Electron’s revenue in the June quarter, will likely fall to less than 40% in October-March, and comprise around 25% to 30% in the future as overall sales of equipment rise, Kawai said.

)

Tokyo Electron, which makes machines that develop, pattern and clean silicon, is focusing on expanding its market share against rival Applied Materials Inc. The company’s seeking certification for mass production of cryogenic etching, which can process stacked NAND memory at high speeds and is an area led by US competitor Lam Research Corp. The Japanese firm has also acquired certification to develop conductor etching for DRAM and cleaning equipment for advanced logic chips.

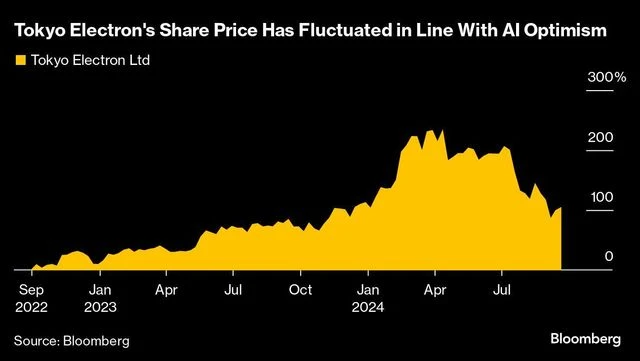

Tokyo Electron’s stock price has tumbled since hitting a record high in April, and shares are now up just around 7% this year, partly due to fluctuations in investor sentiment toward AI. Demand for AI-related servers and other hardware is very strong, Kawai said. But he said AI is only one part of the semiconductor growth story.

“The market focuses too much on AI,” Kawai said. “There’s so much potential for growth.”

First Published: Sep 27 2024 | 8:10 AM IST

![Best Weight Loss Supplements [2022-23] New Reports!](https://technologytangle.com/wp-content/uploads/2022/12/p1-1170962-1670840878.png)