In the latest deal for the red-hot radiopharmaceutical field, Alpha-9 Oncology announced an oversubscribed $175 million series C financing to support advancement of its pipeline. The financing was led by Lightspeed Venture Partners and Ascenta Capital, and included a selected syndicate of new investors. Evan Rachlin, MD, co-founder and managing partner of Ascenta Capital will join the company’s board of directors.

The radiopharmaceutical field is estimated to be worth approximately $15B, and there are dozens of many aspiring entrants.

“Alpha-9 is developing a differentiated portfolio that includes multiple radiopharmaceuticals with first in-class and best-in-class potential,” said Shelley Chu, MD, PhD, head of Lightspeed Venture Partners’ healthcare team, one of the investors. “We are impressed with the team’s progress to date and are proud to support the advancement of these programs.”

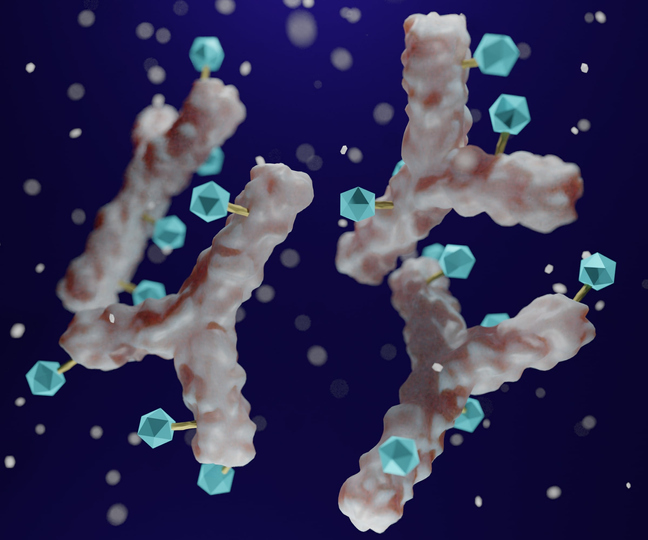

The field of radiopharmaceuticals has evolved a lot following the introduction of radioligand therapies (RLTs)—a form of targeted nuclear medicine that doctors now use to treat multiple types of cancer. RLTs deliver radiation to certain cancer cells that express specific targets.

Radioligand therapies have two key parts that are joined together by a chemical: A radioisotope–a radioactive particle that releases radiation to target cells, and a targeting ligand that attaches to cells that express specific targets, directing the radioisotope to cells.

Alpha-9 uses a differentiated toolbox of binders, linkers, chelators and radioisotopes to design new radiopharmaceuticals. The company says, “Each component is designed for optimal selectivity, stability and payload delivery. Alpha-9 approach is rigorous, fast and capital efficient, generating best-in-class compounds for rapid clinical development.”

Alpha-9 has a diversified portfolio of clinical and discovery assets across both validated and novel targets. The Series C will fund human studies for the clinical stage assets and advancement of discovery stage assets to clinic-ready development candidates. Furthermore, the Series C will fund expanded R&D capabilities and continued investment in CMC and supply chain.

“Over the last few years, Alpha-9 has built a leading radiopharmaceutical company with a deep pipeline and robust infrastructure,” said Alpha-9 CEO, David Hirsch, MD, PhD. “The Series C is an exciting, significant milestone for us and will greatly accelerate our growth. We are thrilled to have the backing of a top-tier investor syndicate who share our belief in the potential of radiopharmaceuticals.”

Alpha-9 has specialized research facilities in Vancouver, which were completed last year and have been operating at scale. These facilities were designed to help to accelerate drug development by streamlining discovery processes. The company has also partnered with isotope suppliers and CDMOs to support its ongoing clinical trials.

“We have been following this space for a long time. What differentiated Alpha-9 was its effective approach to molecule design as well as its thoughtful strategy on infrastructure expansion,” said Rachlin. “We are pleased to support the Company’s continued progress as it strives to deliver on the promise of radiopharmaceuticals.”