Sometimes, a pivot ends up being the smartest decision company leaders can make. See Netflix’s pivot from DVDs to streaming, or Corning’s pivot from lightbulbs to touchscreens.

The list of extremely successful startup pivots goes on. And on. And on.

A less-prominent (but by no means failed) pivot is Numa’s. Its co-founders killed the startup’s original conversational AI product to instead sell customer service automation tools. Not just any tools, though — these tools are targeted at auto dealerships.

That sounds like a highly specific niche, but it’s been profitable, according to Tasso Roumeliotis, Numa’s CEO. The company closed a $32 million Series B round in September.

“We were early to build AI and conversational commerce,” Roumeliotis told TechCrunch in an interview. “But we decided to focus our AI entirely on the automotive vertical after identifying enormous opportunity in that space.”

Roumeliotis co-founded Numa in 2017 with Andy Ruff, Joel Grossman, and Steven Ginn. Grossman hails from Microsoft, where he helped ship headliner products like Windows XP as well as a few less recognizable ones like MSN Explorer. Ruff, another Microsoft veteran, led the team that created the first Outlook for Mac client.

Numa is actually the co-founders’ second venture together. Roumeliotis, Grossman, Ginn and Ruff previously started Location Labs, a family-focused security company that AVG bought for $220 million 10 years ago.

What rallied the old crew behind Numa, Roumeliotis says, was a shared belief in the potential of “thoughtfully applied” AI to transform entire industries. “The market is full of AI and automation point solutions or broad, unfocused tools,” he said. “Numa offers an end-to-end solution that prioritizes the needs of the customer: car dealerships.”

The U.S. has more than 17,000 new-car dealerships, representing a $1.2 trillion industry. Yet many dealerships struggle to manage customer service requests. Per one survey, a third of dealers miss at least a fifth of their incoming calls.

Poor responsiveness leads to low customer service scores, which in turn hurt sales. But Numa can prevent things from getting that bad — or so Roumeliotis claims — by tackling the low-hanging fruit.

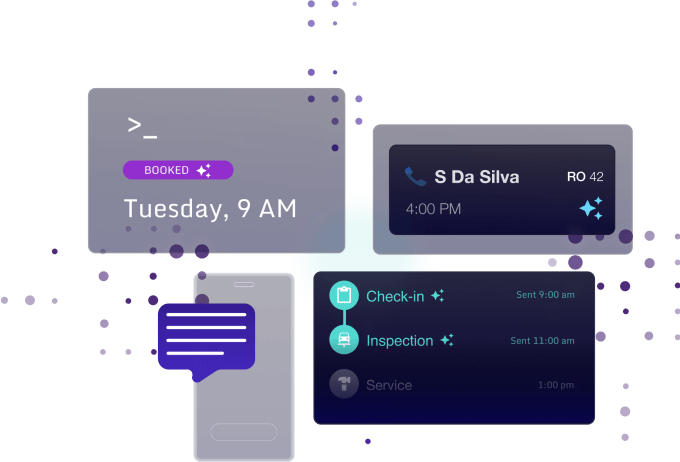

Numa uses AI to automate tasks such as “rescuing” missed calls and booking service appointments. For example, if a customer rings a dealership but hangs up immediately afterward, Numa can send a follow-up text or automatically place a reminder call. The platform can also give customers status updates on ongoing service, and facilitate trade-ins by collecting any necessary information ahead of time.

“Many dealerships still rely on legacy systems that are inefficient and lack integration with modern, AI-driven platforms,” Roumeliotis said. “Today’s consumers expect fast, seamless interactions across all platforms. Dealerships struggle to meet these expectations, especially in areas like real-time communication, service updates and personalized experiences, which AI can help address.”

Other small-time automation vendors (e.g., Brooke, Stella AI) provide products designed to ease dealerships’ customer service burdens. Tech giants, meanwhile, sell a range of generic solutions to automate away customer service. But Roumeliotis argues that Numa stands out because it understands how workflows within dealerships impact the end-customer experience.

“Dealership service leaders and employees are running around constantly, handling customers in person, going out to check on cars and parts, dealing with ringing phones, and balancing coordination with co-workers,” Roumeliotis said. “Numa brings that all together in a way intentionally designed with AI and the user inside the dealership to drive how the platform works rather than the other way around.”

Roumeliotis asserts Numa has another advantage in its in-house models, which drive the platform’s automations. He said the models were trained on datasets from OEMs and dealership systems as well as conversation data between dealerships and clients.

Were each one of these clients, OEMs, and dealerships informed that their data would be used to train Numa’s models? Roumeliotis declined to say. “Numa’s models are bootstrapped by a feedback loop between dealerships, customers interacting with dealerships, and the usage of Numa to facilitate this,” he said.

That answer probably won’t satisfy privacy-conscientious folk, but it’s seemingly immaterial to many dealerships. Numa has 600 customers across the U.S. and Canada, including the largest retail auto dealership in the world. Roumeliotis claims Numa is “just about” cash-flow break-even.

“We don’t need capital to continue scaling revenue,” he added. “Instead, Numa is using its money to accelerate product development by expanding our team of AI and machine learning engineers, including investing in building AI models for the automotive vertical.” The company currently has 70 employees.

Benefitting Numa in its conquest is the willingness of dealerships to pilot AI to abstract away certain back-office work.

According to a survey by automotive software provider CDK Global last year, 67% of dealerships are using AI to identify sales leads, while 63% have deployed it for service. Those responding to the poll were quite bullish on the tech overall, with close to two-thirds saying that they anticipated positive returns.

Touring Capital and Mitsui, a Japanese conglomerate that’s one of the largest shareholders in automaker Penske, led Numa’s Series B round. Costanoa Ventures, Threshold Ventures, and Gradient, Google’s AI-focused venture fund, also participated in the round. The funding brings Oakland-based Numa’s total raised to $48 million.

![Best Weight Loss Supplements [2022-23] New Reports!](https://technologytangle.com/wp-content/uploads/2022/12/p1-1170962-1670840878.png)