State administrations ramped up new outlays by 67% to nearly ₹1.62 lakh crore, outnumbering Central government capex plans which, however, recorded a sharper spike of 185.6% to hit around ₹1.54 lakh crore in Q2.

| Photo Credit: Getty Images/iStockphoto

Fresh investment plans bounced back strongly in the July to September quarter, with government capex recovering from a lull in the first quarter amid the general elections and private investors also stepping up albeit at a slower pace, lifting new project outlays to the second highest level over the past year and a half.

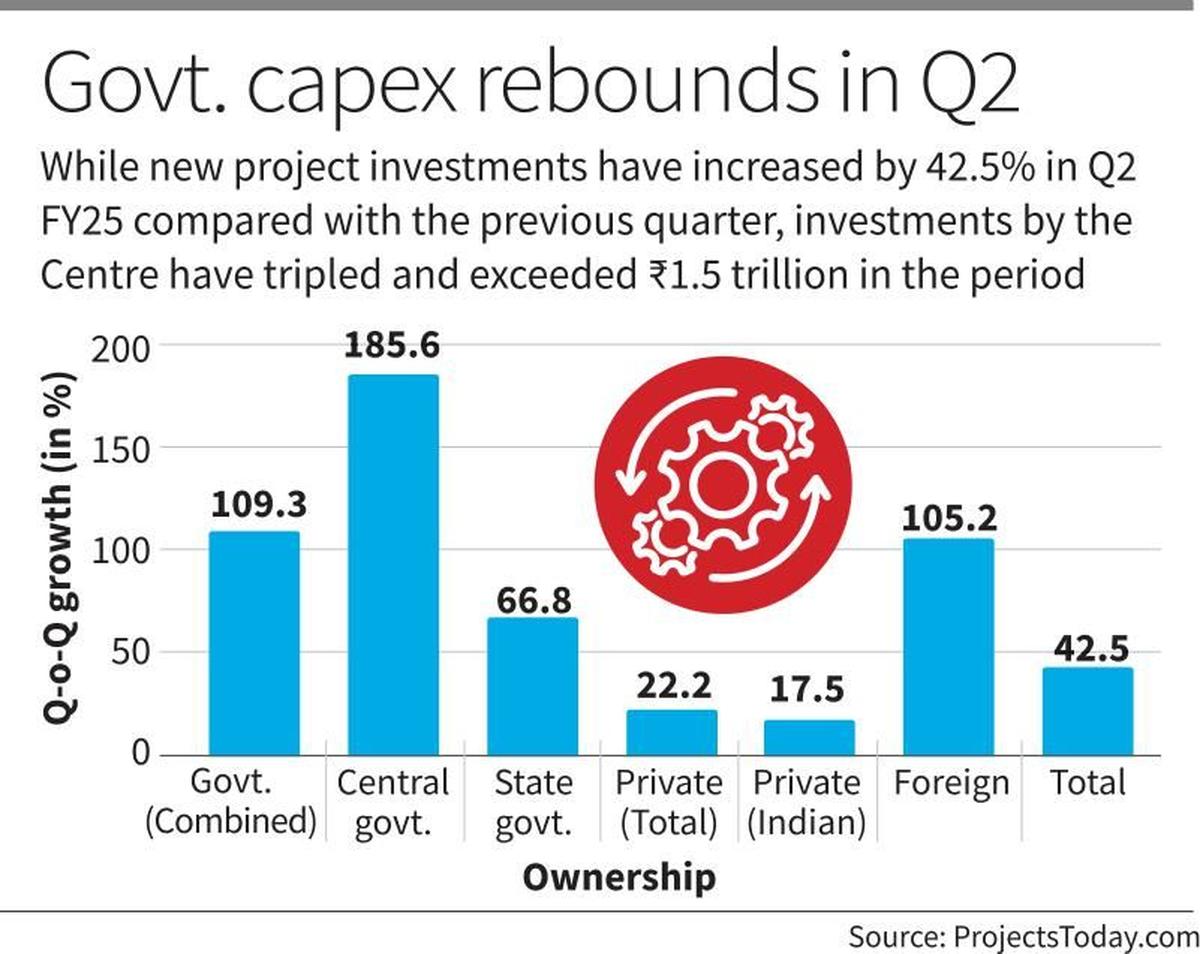

Overall investments jumped 42.5% in the second quarter (Q2) of 2024-25 to ₹9.21 lakh crore, relative to the April to June quarter or Q1, when new investment announcements had more than halved on a sequential basis to ₹6.46 lakh crore. State administrations ramped up new outlays by 67% to nearly ₹1.62 lakh crore, outnumbering Central government capex plans which, however, recorded a sharper spike of 185.6% to hit around ₹1.54 lakh crore in Q2.

Private sector investments grew at a more sober pace of 22.2%, but accounted for nearly 66% of the total investment tally, with foreign investors doubling their planned bets on the Indian market from Q1, to ₹54,519 crore in Q2. Domestic private capital recorded a 17.5% uptick in the value of new investment plans, accounting for ₹5.51 lakh crore of fresh outlays, as per data from Projects Today, which has been tracking new and ongoing investment projects in the country since 2000.

Maharashtra on top

Among the States, Maharashtra remained the top draw for investors as was the case in Q1, with 661 projects worth ₹2.81 lakh crore. Gujarat recovered from the fifth spot in Q1 to attract the second highest investments worth almost ₹1.39 lakh crore in Q2.

Karnataka, with ₹97,740 crore of new projects, and Tamil Nadu (₹46,662 crore) stood third and fourth in Q2, regaining ground from Q1, when they had dropped to the eighth and 10th positions, respectively. The erstwhile State of Jammu and Kashmir made a maiden entry into the list of top 10 States, drawing investment plans worth ₹18,592 crore.

“In the first quarter of this fiscal year, major project announcements by the Central government agencies were postponed due to the election code of conduct during the Lok Sabha polls, and the private sector had also delayed unveiling major capital expenditure plans. However, with a stable government reinstated at the Centre on June 9, the second quarter has witnessed an upsurge in investment announcements by both the public and private sectors,” Projects Today director and CEO Shashikant Hegde told The Hindu.

Mining was the only sector to record a quarter-on-quarter contraction in fresh investment projects in Q2, with an 18.1% decline, while manufacturing outlays soared nearly 79% to over ₹2.22 lakh crore and new infrastructure projects jumped 45% to about ₹4.17 lakh crore. Electricity and irrigation projects rose 24.2% and 24.7%, respectively.

Of the 2,684 new investments announced in Q2, 1,093 were government projects, while 1,591 were from the private sector. The Projects Today survey noted that the number of mega projects worth at least ₹1,000 crore, increased from 132 plans worth ₹4.02 lakh crore in Q1 to 173 projects worth ₹6.38 lakh crore in Q2, indicating improved confidence among project promoters.

Mr. Hegde anticipated that this upward trend in project investments will persist over the next two quarters but stressed that the key to unlocking the full potential of these investments lies in swift and effective execution. “Ensuring timely implementation of announced projects is crucial for India to not only meet its higher growth aspirations but also generate much-needed employment opportunities,” he underlined.

Published – October 28, 2024 03:00 am IST