The share of Russian crude rose to a record 28% of India’s oil imports in January, with Russia remaining the top supplier followed by Iraq and Saudi Arabia. Russian crude accounted for 0.2% of India’s oil imports due to uneconomical transport logistics before Moscow sent troops into Ukraine on February 24 last year.

Last month India’s imports of Russian Sokol crude oil were the highest so far at 100,900 bpd, as output from the Sakhalin 1 field resumed under a new Russian operator, news agency Reuters reported.

As the West responded with sanctions followed by a price cap and a ban on importing Russian crude, Indian refiners started lapping up the shunned barrels at discounts. In 2021, Russia was at the 17th spot, supplying about 1% of India’s overall imports.

India meets more than 85% of its oil demand via imports, which makes it highly vulnerable to price volatility. The state-owned refiners, who have been prevented by the government from raising pump prices of diesel and gasoline since May, have increasingly favored cheaper Russian imports.

India’s Iraqi oil imports in January rose to a seven-month high of 983,000 bpd, up 11% from December, the data showed.

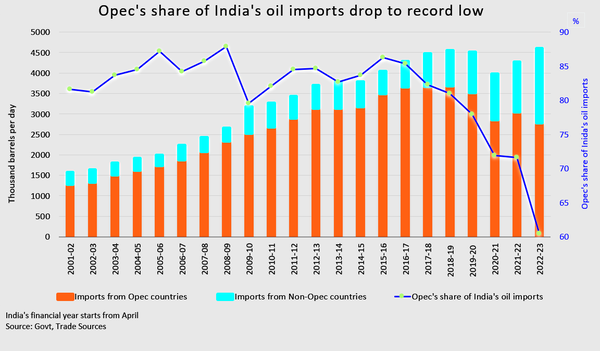

Opec‘s share of India’s oil imports drop to record low

India’s oil imports have dragged down Opec’s share to the lowest in more than a decade, data obtained from industry sources show.

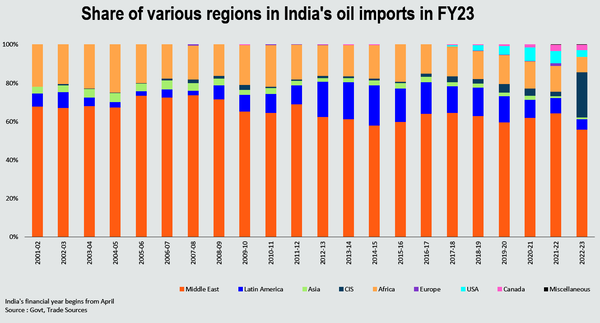

Members of the Organization of the Petroleum Exporting Countries (OPEC), mainly from the Middle East and Africa, saw their share in India’s crude imports shrinking to 64.5% in 2022, from a peak of 87% in 2008, a Reuters analysis of the data since 2006 showed.

Still, Iraq and Saudi Arabia remained India’s top two suppliers last year.

At the India Energy Week 2023, oil ministry officials pointed to foreign minister S Jaishankar and oil minister Hardeep Singh Puri making India’s stand clear at various global forums broadly saying India will buy oil from anywhere in the world, including Russia, to fuel economic growth and lift millions out of poverty.

(With agency inputs)

)

)