HCLTech, India’s third-largest IT services company, has raised the lower end of its FY25 revenue growth guidance by 50 basis points, bolstered by increased client spending. The Noida-headquartered firm is now estimating revenue growth between 3.5 per cent and 5 per cent.

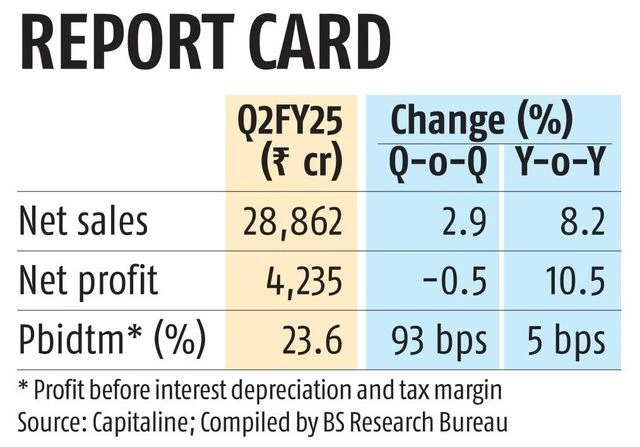

For the second quarter of 2024-25, HCLTech posted a net profit of Rs 4,235 crore, marking a 10.5 per cent year-on-year increase, though earnings remained flat on a sequential basis. Revenue for the quarter reached Rs 28,862 crore, up 8.2 per cent from the same period last year and growing 2.9 per cent sequentially. In US dollar terms, revenue rose by 6.8 per cent year-on-year and 2.4 per cent quarter-on-quarter.

The IT major’s performance for the quarter under review outpaced Bloomberg consensus estimates, which had forecast revenue of Rs 28,637 crore and net profit of Rs 4,061.6 crore.

Total contract value (TCV) for Q2 stood at $2.2 billion, up from $1.96 billion in the previous quarter.

“We have done well in the first half of the financial year, even when compared to our internal assumptions. This has made us increase the lower end of the guidance. Discretionary spends were also better in Q2 than in Q1,” said C Vijayakumar, CEO and MD, HCLTech during a media briefing.

)

Sector-wise, the telecommunications, media, publishing, and entertainment vertical led growth — at 61.2 per cent year-on-year — followed by manufacturing (7.1 per cent), retail & consumer packaged goods (6.2 per cent), and technology & services (5.6 per cent). However, the banking, financial services, and insurance (BFSI) segment saw a 4.5 per cent decline.

Vijayakumar, however, noted that demand in the BFSI segment has been showing signs of improvement across various geographies.

Shaji Nair, research analyst at Sharekhan by BNP Paribas, said: “The company reported strong revenue growth and margin beating estimates, with growth being well distributed across verticals. The pipeline remains strong with data & AI, digital engineering, SAP migration and efficiency-led programmes. With softer quarters behind, we believe the company would continue to deliver industry leading growth among Tier 1 companies. We have a “buy” rating on the stock.”

Biswajit Maity, senior principal analyst at Gartner, highlighted HCLTech’s resilience amid macroeconomic uncertainties. “HCLTech is investing heavily in digital infrastructure capabilities, emphasising sustainability and operational efficiency to stay competitive,” Maity said, noting that a third of HCLTech’s revenue has been generated from clients in the finance, life sciences, and healthcare sectors. “However, there has been a slight decline in revenue from the Americas, signalling the need for HCLTech to focus more actively on this key market, as it remains one of their primary regions,” he added.

The company also reported strong momentum in deals led by its Generative AI initiatives, with 25 deals involving its AI platform, AI Force.

HCLTech’s total headcount dropped by 780 during Q2FY25. The total was 8,080 in the previous quarter.

The attrition stood at 12.9 per cent. The company, on the other hand, onboarded 2,932 freshers in the quarter under review. Ramchandran Sundararajan, chief people officer, attributed the headcount decline to efficiency measures. “On a year-on-year basis, our headcount has grown, if you remove the State Street JV coming to an end,” he said, adding the company will implement annual salary hikes, averaging 7 per cent, in October, with top performers receiving double-digit increases between 12 per cent and 15 per cent.

First Published: Oct 14 2024 | 6:13 PM IST

![Best Weight Loss Supplements [2022-23] New Reports!](https://technologytangle.com/wp-content/uploads/2022/12/p1-1170962-1670840878.png)