New Delhi:After a prolonged struggle that included a legal battle, the medical device industry has successfully persuaded Indian regulators to support their call for disallowing the import of refurbished medical devices, citing potential risks to product efficiency and patient safety.

This issue came to the forefront on January 10th when Deputy Drugs Controller Aseem Sahu, in a letter to the Principal Commissioner of Customs, highlighted that under the current Medical Devices Rules (2017), there is no specific provision for regulating refurbished medical devices. “No license is issued for importing such devices, and they cannot be imported into the country either for sale or distribution,” he clarified.

In 2023, the Ministry of Environment, Forest, and Climate Change (MoEFCC) allowed the import of refurbished medical devices under the Hazardous and Other Wastes (Management and Transboundary Movement) Second Amendment Rules, as part of India’s e-waste management strategy. While this decision opened a new market, concerns about its implications have emerged.

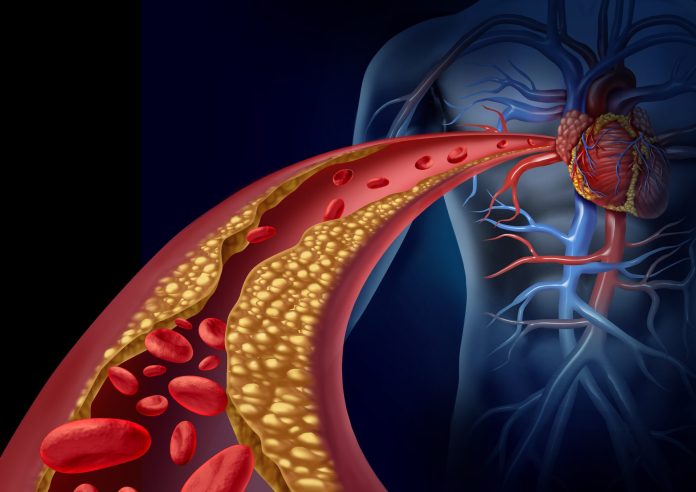

Dr. Aakaar Kapoor, a radiologist and CEO, City Imaging & Clinical Labs, pointed out risks in the diagnostic segment. He noted, “Refurbished machines raise significant concerns about radiation emissions, which can harm patients. In contrast, newer equipment uses less contrast agent, reducing patient exposure to radiation and intravenous contrast, especially for younger patients and those requiring repeated imaging, such as cancer patients.”

In October 2023, a patient advocacy group—the Patient Safety and Access Initiative of India Foundation (PSAIIF)—filed a public interest litigation (PIL) in the Delhi High Court. They raised concerns about the large-scale illegal import of high-value refurbished medical equipment. However, the PIL was dismissed due to the lack of provisions in existing regulations.

Despite these concerns, the pre-owned medical equipment market constitutes approximately 10 per cent of India’s total medical equipment industry, translating into a subset worth ₹1,500 crore, according to the Medical Technology Association of India (MTaI). The market predominantly serves Tier II, III, and IV cities, as well as rural and underserved areas, where lower income levels heavily influence purchasing decisions.

The ban on refurbished device imports is likely to create a supply gap, especially in Tier II and III regions. Domestic and international manufacturers may seize this opportunity, potentially driving prices upward.

Rajiv Nath, Forum Coordinator for the Association of Indian Medical Device Industry (AiMED), said, “Indian manufacturers compete more effectively in tier II and tier III cities, where supply chains and service support from domestic producers are more reliable. We expect a scenario similar to the automotive and mobile phone sectors, where local manufacturing led to stable pricing and increased consumer demand.”

Nath also noted that global manufacturers may join India’s “Make in India” initiative due to the market’s vast potential.

However, India’s heavy reliance on imports poses challenges. In FY 2023–24, India imported ₹69,000 crore worth of medical devices, marking a 13 per cent increase from the previous year. Experts highlight that even developed countries like the US and EU depend on pre-owned medical equipment for 7–9% of their healthcare needs, under strict regulations.

Gaurav Aggarwal, Managing Director, Involution, emphasised that growing domestic manufacturing capabilities will create opportunities for the support industry. However, he added, “The existing Medical Device Rules need to include extra safeguards for refurbishing or remanufacturing equipment beyond their extended warranty periods. Informal sectors currently refurbishing imported devices can redirect their expertise toward indigenously produced equipment.”

The Health Ministry is reportedly working to form a high-level committee to develop regulations for refurbished medical devices in consultation with stakeholders. Nath suggested that India follow UN-based public procurement systems and incentivize quality-based criteria, along with indigenous design preferences.

For a short-term solution to avoid disruptions and price hikes, MTaI has proposed allowing imports under necessary approvals from the Directorate General of Health Services (DGHS) and the Ministry of Environment.

The growing use of refurbished medical devices raises serious patient safety concerns, but in a market heavily reliant on imports, the only sustainable solution lies in building a competitive domestic industry with global-standard manufacturing capabilities.

![Best Weight Loss Supplements [2022-23] New Reports!](https://technologytangle.com/wp-content/uploads/2022/12/p1-1170962-1670840878.png)