The central government announces the interest rate for small savings schemes every quarter. Most of the post office savings schemes are very popular investment options, especially for conservative investors that are looking for products with sovereign guarantee.

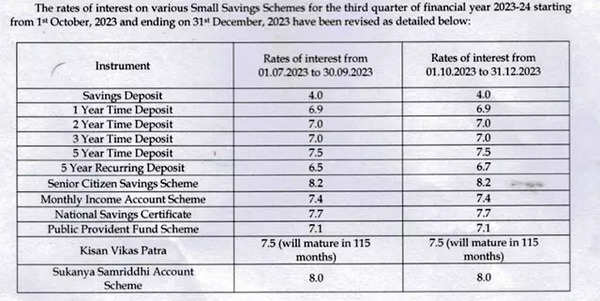

Earlier, in June, the government had hiked interest rates on select small saving schemes by up to 0.3% for the July-September quarter. Notably, the highest increase of 0.3 per cent was for the five-year recurring deposit (RD). Interestingly, even as bank fixed deposit rates rates touch new highs, many small savings schemes are still fetching more returns.

PPF, Senior Citizen Savings, NSC, Sukanya Samriddhi, MIS, Small Saving Schemes Explained & Compared

Earlier this month in an interaction with TOI Wallet Talks, Prableen Bajpai, Founder, Finfix ®️ Research & Analytics Pvt Ltd said that she does not expect PPF interest rate to go up too much. “The government would want to incentivize the new tax regime. So, maybe we won’t see a higher interest offering on this particular product. That is what my personal opinion is that probably it would hover around these rates only and they would not make it more attractive than what it currently is.

Asked about the best investment option among small savings schemes she said, “My favourites for long-term savings would definitely be the Public Provident Fund and Sukanya Samriddhi. Senior Citizen Savings Scheme remains a great option for investors who are retirees. The other ones – I think there are still other options available with a lot of passive debt funds,” she told TOI.

)

)

)