NEW DELHI: The Supreme Court on Friday stayed Goods and Services Tax (GST) proceedings against 49 online gaming companies over retrospective demand notices issued to them, a decision that pushed up the share price of some of the listed entities.

A bench of Justices J B Pardiwala and R Mahadevan passed the interim order, while posting the matter for further hearing to March 18.

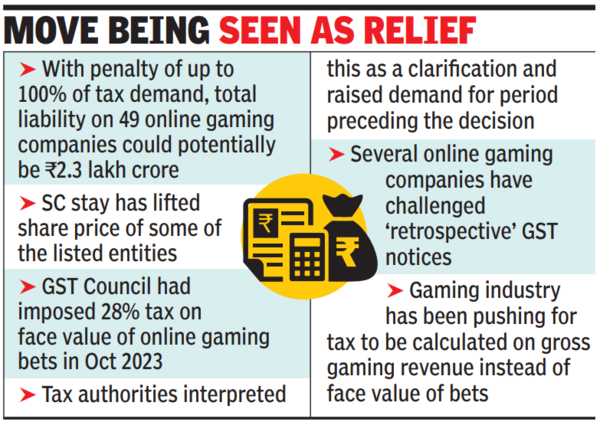

Market players saw the SC stay as a relief for online gaming companies, which had received show-cause notices alleging GST evasion of Rs 1.1 lakh crore. As the GST Act allows government to impose a penalty of up to 100 per cent of the tax demand, the total liability could potentially be Rs 2.3 lakh crore.

In October 2023, the GST Council had imposed a 28% tax on the face value of online gaming bets, which authorities interpreted as a clarification and raised tax demand for the period preceding the decision. Various online gaming companies have challenged the ‘retrospective’ GST notices.

The gaming industry has been advocating for the tax to be calculated on gross gaming revenue (GGR) rather than the face value of bets. Before the decision, the companies were levying 18% tax on the platform fees or GGR.

“While the GST resolution may take time, we remain optimistic that a fair resolution will not only provide the much-needed clarity but also accelerate innovation, job creation, and investor confidence. This clarity is crucial for many companies preparing to go public, positioning the Indian gaming ecosystem for global leadership that India deserves. With the right policies in place, India is poised to seize this once-in-a-millennium opportunity to lead the global consumer tech landscape,” said Saumya Rathore, co-founder of Winzo, one of the petitioners along with entities, such as Gameskraft, Games24x7. Several petitions pending in High Courts have also transferred to the apex court.

In Sept 2023, SC stayed a Karnataka High Court judgment, quashing a GST notice against Gameskraft for alleged evasion of Rs 21,000 crore. The powerful gaming lobby has been seeking a reversal of the GST Council decision, arguing that it will hurt the industry. In Oct 2023, some states had sought a review after six months, but the GST Council had not discussed the matter, amid numbers showing that the bleak picture painted by the gaming companies was not true.

On a day when sensex fell 0.3% or 231 points, casino operator Delta Corp gained 4.9% to close at Rs 118.9. Similarly, OnMobile stocks closed 0.6% stronger, while Nazara Tech, whose shares gained 8.5% after the SC stay, closed 3.3% lower.