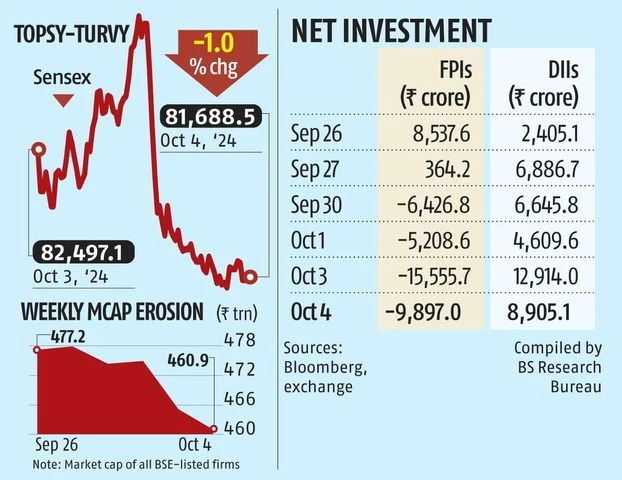

India’s benchmark indices fell nearly a per cent on Friday in a topsy-turvy session to cap their worst weekly performance in more than two years.

A deepening conflict in West Asia triggered risk-off bets from global investors and raised the risk of a runup in oil prices.

Click here to connect with us on WhatsApp

The markets also came under pressure on concerns over foreign portfolio investors (FPIs) pulling out from India to invest in China, where valuations are attractive.

The Sensex and the Nifty fell about 4.5 per cent for the week – the biggest decline since June 2022.

Falling for a fifth straight session, the Sensex declined 1 per cent, or 809 points, to settle at 81,689.

The Nifty also dropped 0.9 per cent, or 236 points, to end at 25,015. Both indices fell over 2 per cent from the day’s highs.

The total market capitalisation (mcap) of BSE-listed companies fell by Rs 4.2 trillion to Rs 461 trillion.

This week’s rout has shaved off over Rs 16 trillion from India’s mcap.

)

Meanwhile, Hong Kong’s Hang Seng rose 10.2 per cent, and Shanghai Composite Index surged 8.1 per cent this week, buoyed by the aggressive stimulus measures by the central government to boost its economy.

The rising tensions between Israel and Iran has left investors worried about its impact on crude oil prices.

Crude oil imports form a major chunk of India’s import bills.

Tensions between Israel and Iran’s proxies in Lebanon, Gaza and Yemen have been brewing for a while, but Iran’s direct missile attack this week on Israel has stoked fears of the tensions snowballing into a full-blown conflict.

Some estimates suggest that if Israel were to mount a serious offensive against Iran’s oil facilities, it would take 1.5 million barrels of daily supply off the market.

)

“Depending on what Israel does, the fear globally is that they might target Iran’s oil assets, and if Iran retaliates by blocking key sea routes, the cumulative effect would be oil spiralling to $100 a barrel. It affects inflation globally, and India would be disproportionately affected by our import bill. India has always been overbought, and now it’s just nervousness due to adverse news flows,” said Andrew Holland, CEO of Avendus Capital Public Market Alternate Strategies.

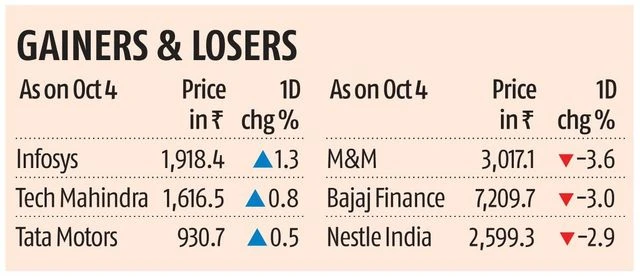

The market breadth was weak, with 2,387 stocks declining and 1,563 advancing. HDFC Bank, which fell 1.5 per cent, and Reliance Industries (RIL), declining 1.5 per cent, were the biggest contributors to Sensex’s losses. RIL, the country’s most valuable firm, declined over 9 per cent in the past one week.

“The pessimism on the market is expected to continue in the near term amidst rising crude prices, and fund flows to cheaper markets like China,” said Vinod Nair, head of research of Geojit Financial Services.

FPIs were the net sellers of Rs 9,897 crore on Friday, while domestic institutions bought shares worth Rs 8,905 crore.

FPIs were the net sellers of equities worth Rs 37,088 crore this week, and domestic institutions bought shares worth Rs 33 074 crore. On a five-day rolling basis, FPI selling is the highest in 24 years.

First Published: Oct 05 2024 | 12:01 AM IST