NDTV’s Prannoy Roy discusses the top 10 trends of global economy in 2023 with Ruchir Sharma, the Founder of Breakout Capital and Chairman of Rockefeller International. In his forecast, Mr Sharma says that the global economy, which is slowing down, is in for the long grind. He feels that this will also have a impact on India’s economy, which may not grow above a rate of 5 per cent.

Mr Sharma also feels that India needs to seize the outsourcing opportunities with several countries looking for an alternative to China.

Here are the highlights from Prannoy Roy’s show:

Get NDTV UpdatesTurn on notifications to receive alerts as this story develops.

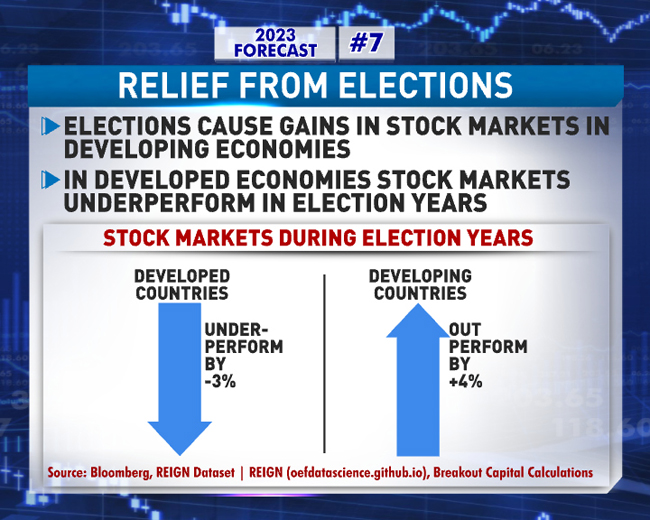

In 2023, Focus Will Be On Smaller Elections

“It’s quite an extraordinary coincidence that we don’t have too many elections this year taking place, national elections, and so the focus may be on some of the smaller elections like Turkey, Nigeria. But generally it’s quite extraordinary where you have a year with no big election around the world,” says Ruchir Sharma.

India Needs To Seize Outsourcing Opportunities

Ruchir Sharma: People are still looking to outsource to countries such as America because the wages there are so much higher, but they don’t want to do it to China anymore due to geopolitical reasons, and wages in China have gone up significantly, so therefore the outsourcing shifts to places in Asia including India, but we need to seize that opportunity.

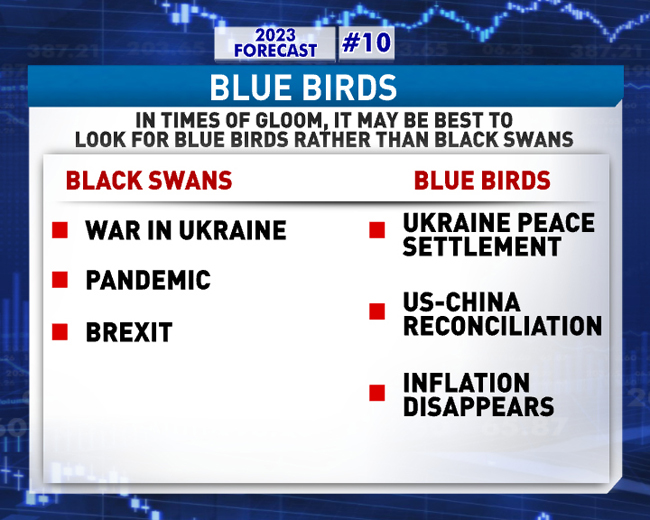

2023 May Be The 1st Time That Economists Called A Recession

Ruchir Sharma: In the history of surveys, economists have never forecast a recession. So if a recession does happen in 2023, it will be the first time in the history of surveys that economists actually called a recession. But the broader point here is that generally, there is a lot of gloom around the world, and it’s partly because of economics and partly because of politics because we’ve been through such a difficult period. There was the pandemic, and then there was the invasion of Ukraine, and then politics in many countries was not that favourable, with all sorts of surprise election results, and now black swans in general have become, rightly or wrongly, a symbol for what could go wrong.

Relief From Elections

“Among democracies, there isn’t a single country that’s having elections in 2023, and that hasn’t happened this century, so it’s quite a coincidence that it’s happened,” says Ruchir Sharma.

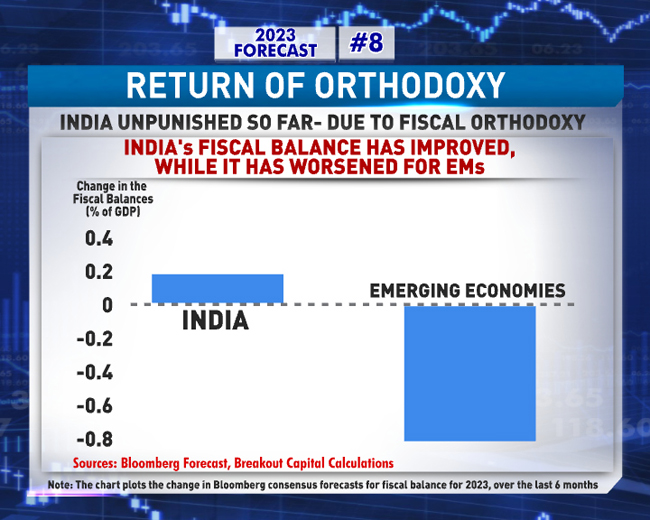

Prannoy Roy: Your next point is that there will be a return to orthodoxy, and what do you mean by that?

Ruchir Sharma: Because the era of easy money is over, interest rates have risen everywhere. Financing in general has become much more difficult. In this environment, the scope for policymakers to do something too experimental, something away from what is defined as economic orthodoxy, which is that you need to follow a tight fiscal policy, you need to have relatively high interest rates, if you try do so something different the markets going to come and punish you.

What Japan’s Resurgence Means For India

“Japan’s been a major investment partner of India. Having a healthier Japan with better corporate balance sheets could further that process,” says Ruchir Sharma.

Ruchir Sharma: I’ve heard that some of India’s leading services, if they were to buy, say, 30 or 25 to 30 movies directly to go digital, that number is likely to be in the single digits, maybe 6 or 7.

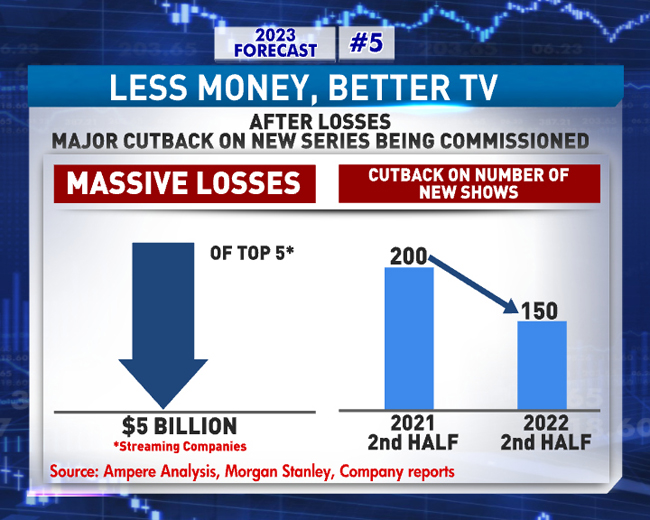

Less Money Meant Better TV?

“We saw a surge in the number of new streaming services, and we saw so much cheap money available to fund new projects and new series so global content spent on television surged over the last few years. But my point is that quality went down. That so many shows were commissioned which were possibly poorly conceived with the script or the concept was improperly done, but just in a hurry to get new subscribers,” says Ruchir Sharma.

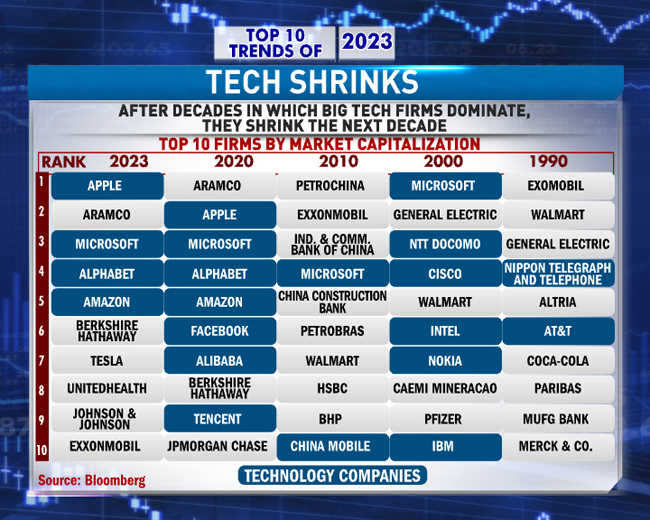

Ruchir Sharma: By market value, the top ten tech firms in the world at the beginning of every decade change, and as you can see, eight to nine of them change.

“When we had the last tech boom, which ended in 2000, the top tech firms in the world then were very different from what you have today; those days you had Cisco, Intel, and IBM. The only survivor in a way has been Microsoft,” adds the global investor.

America Down, Rest Of The World Up

Ruchir Sharma: After this very extraordinary decade that America has had of great performance, I think that it is now set to underperform in the coming decade. Also because its size has become disproportionate, it will allow other countries, including emerging markets such as India, to do much better than America. That’s my forecast, and I think in 2023 we are likely to see shades of that play itself out.

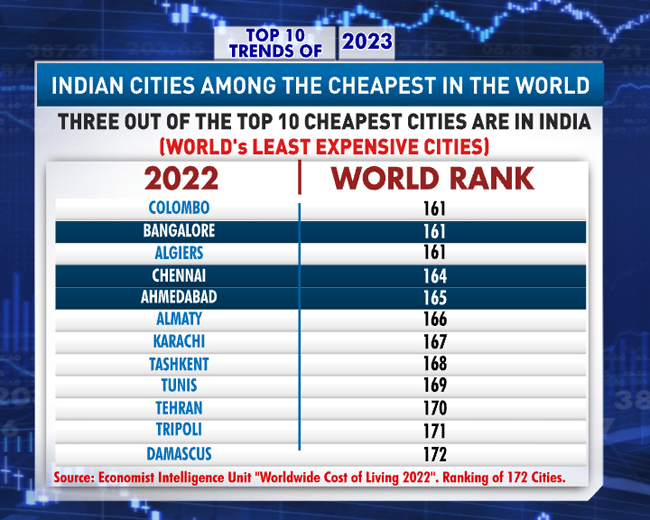

Three out of the bottom ten cheapest cities are in India. Among the world’s least expensive cities are – Bangalore, Chennai and Ahmedabad, says Ruchir Sharma.

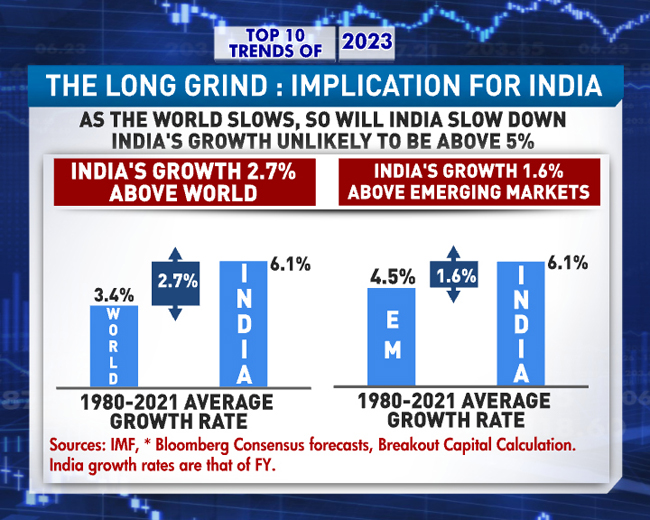

India’s growth will slow as the global economy slows down, discuss Prannoy Roy and Ruchir Sharma. Mr Sharma feels it will be nearly impossible for the India’s growth rate to be above 5 per cent this year.

“The global economy been slowing down and yet unemployment rates around the world are close to record lows.It is very hard to get people to come back into the labor force. A lot of people are still living off a lot of the stimulus that was put doing the pandemic,” says Ruchir Sharma.

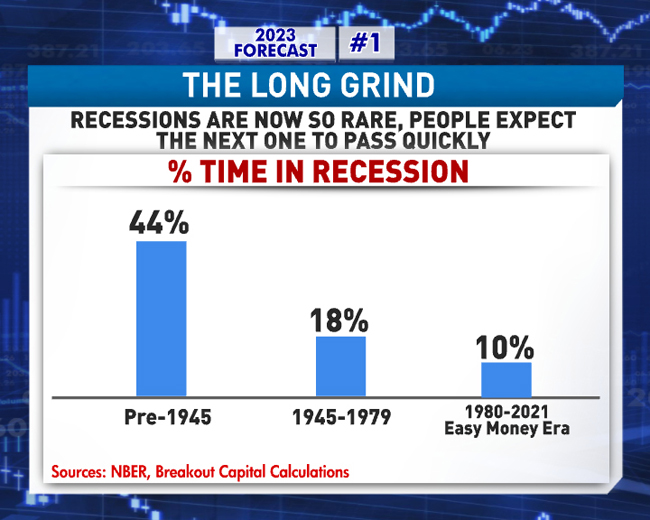

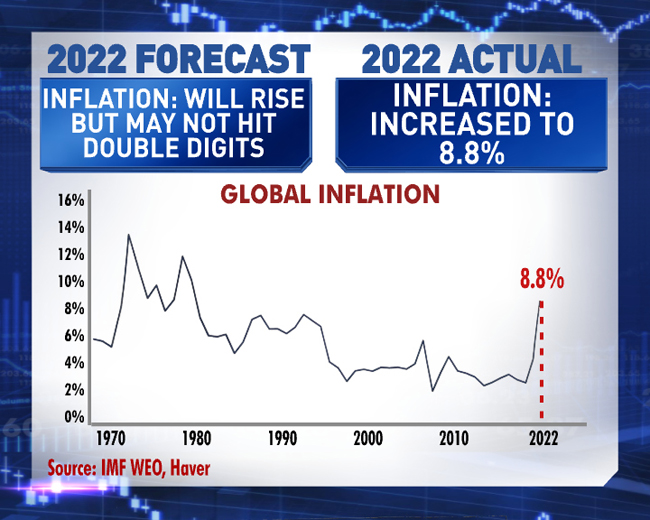

Ruchir Sharma: In the last three or four decades, because inflation was low and falling the governments and central banks were able to come out there and put out a lot of stimulus and that was particularly true in the pandemic that we saw stimulus like never before during the pandemic.

Why Is Everybody Worried About TikTok

When asked about why is everyone worried about TikTok, global investor Ruchir Sharma says, “I think it’s pretty obvious. It’s Chinese and so popular and I think that they have very sophisticated algorithm AI systems which I think a lot of people feel sort-of breaches the line.”

Prannoy Roy: “Employees or staff say they are productive at home so let me stay at home. Eighty seven per cent employees say they are productive at home but their bosses say, sorry I don’t believe you. Only 12 percent of bosses believe that employees are productive at home. What’s the truth?”

Ruchir Sharma: “It depends who you ask. If it’s clearly not showing up in the productivity numbers, maybe the bosses are a bit more correct, we don’t know or it’s too complicated a model, but I find this fascinating about this dichotomy in terms of what the employees believe and what the bosses believe.”

Why Tech Boom Hasn’t Improved Productivity

“I think a good reason for that could be the fact that you have too many inefficient zombie companies are which are kept alive. One statistic like in the US, the number of inefficient zombie companies, companies that are not able to even service their deals without borrowing more and more that, that number too shot up from nearly two percent in the 1980’s to nearly twenty percent now,” says Ruchir Sharma.

High Debt On Private Sector In Developed Economies

“Developed countries like the US have taken on so much debt on the private sector side in terms of the firms, that as interest rates have gone up, the cost of servicing the debt has been going up a lot,” says Ruchir Sharma.

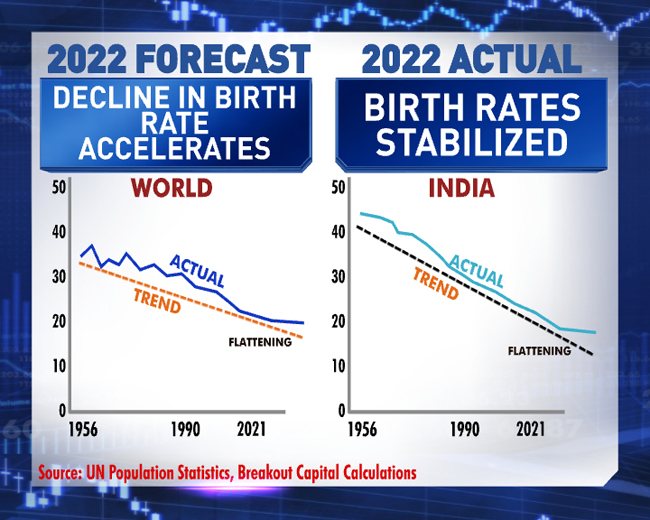

Demographic Changes Affecting Global Economy

The global economy which used to grow at let’s say at 3.5-4% now is lucky to grow at 2.5-3% largely because of the demographic changes.