At 9.36%, this corporate FD beats SBI, small savings schemes like NSC, PPO etc in returns (Representative image)

Photo : iStock

However, the recent hikes in FD rates offered by banks and most NBFCs remain unmatched by the quantum of hikes in small savings schemes.

Photo : ET Now Digital

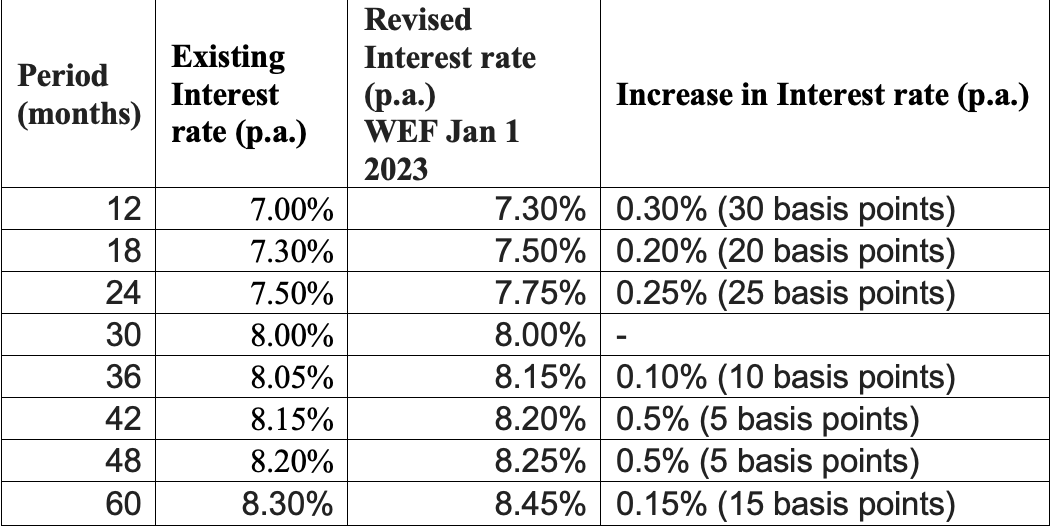

Shriram Finance Limited (SFL) a part of Shriram Group, has announced a hike in fixed deposit (Shriram Unnati Deposits) rates by 5 to 30 basis points (0.05% p.a. to 0.30% p.a.) across different tenures. Depositors can earn interest up to 9.36% on FDs, effective from January 1, 2023. Additional 0.25% pa will be paid on all renewals.

Sriram Finance corporate FD offers an additional 0.50 per annum to senior citizens. The scheme is also offering an additional 0.25% on all renewals. Women depositors will be given an additional 0.10% under the scheme.

For comparison, the rate offered on National Savings Certificate (NSC) for the January-March quarter after Friday’s hike went up to 7; the rate on the senior citizen savings scheme is now 8% interest against 7.6% earlier.

Interest rates on Post Office Term Deposit schemes of duration 1 to 5 years have been hiked by up to 110 bps or 1.1 percentage points.

The government operates 12 types of small savings schemes, including Post Office Savings Schemes, PPF, Sukanya, Senior Citizen Schemes, National Savings Certificate, etc. The central government reviews interest rates on small savings schemes every three months.

Sriram FD Vs SBI Bank: rate comparison

Photo : ET Now Digital

SBI Bank offers a maximum interest rate of 6.90% on deposits of duration 5 years and up to 10 years for deposits aged below 60, while senior citizens are offered 7.25%. SBI FD rate for deposits of duration 1 year to less than 2 year is 6.60%, and 7.25% for senior citizens on the same tenor. SBI FD with a duration of 2 years to less than 3 years now offers 6.75%, and 7.25% to senior citizens.