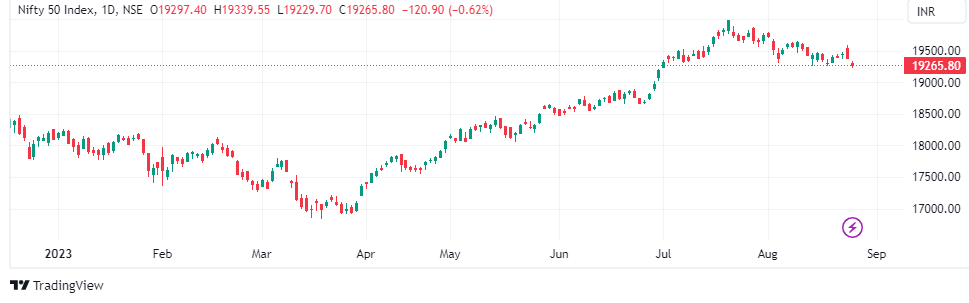

The Nifty 50 had to close above the 19,300 mark on Friday to prevent a weekly loss. It failed to do so. It was almost inevitable given the weak global cues and the lack of strength the market has seen at higher levels. The only solace? It is still within the 19,250 - 19,300 support cluster, having reversed from its intraday low of 19,229.

Five straight weekly drops is the first instance for the index since April-May 2022. We are also entering the final week of the August F&O series. This time around, the Nifty 50's four series winning streak is set to end. For the series so far, the index is down 400 points.

All eyes are now on the Reliance Industries AGM, as to whether it can cushion the downside for the Nifty 50, and provide a much needed reversal in an otherwise bearish market.

"Nifty 50 closing the week below the support level of 19,300 indicates that the bears have the upper hand going into the monthly F&O expiry," said Ashwin Ramani of SAMCO Securities. He said that in case the index does not close above 19,300, there is a high change of the bears pushing the index down towards levels of 18,800 - 19,000.

Nagaraj Shetti of HDFC Securities said that there is a high possibility of some more weakness in the coming sessions for the Nifty 50, although he does not rule out a near-term bounce from the key support levels of 19,000. Immediate resistance is at levels of 19,380.

The Nifty 50 may have declined for the fifth week in a row but the Nifty Bank had a narrow escape. The index may have ended 250 points lower on Friday but it managed to not only hold on to the 44,000 mark on the downside, but also close above 43,851, thereby preventing its worst losing streak in three-and-a-half years.

Kunal Shah of LKP Securities describes the Nifty Bank range to be between 44,000 - 45,000. "A decisive break on either side of this range could trigger trending moves. Despite this, the prevailing bias appears to lean towards the bullish side within the range," he said.

Nifty Bank's price range has entered consolidation mode with buying interest emerging at lower levels, said Rajesh Bhosale of Angel One. 43,800 - 43,600 is the support level for the index, while immediate resistance is between 44,500 - 44,800. A firmer resistance on the upside is at 45,000, he added.

"One thing I can tell you, which we have been waiting for, and many investors have been waiting for, they announced about four years back at the AGM, that in five years, both Jio platforms, as well as retail will be separate companies where investors will be able to participate. I think we are now eagerly waiting. I wish we could buy into Reliance Retail today, we can't, some of us will also wish we can buy into Jio Platforms, which is probably the telecom business, I think we can't buy into those businesses. So that announcement will be eagerly awaited," Sudip Bandopadhyay, Group Chairman, Inditrade Capital said.

What Are The F&O Cues Indicating?

Nifty 50's futures added 5.4 percent in Open Interest. They are now trading at a discount of 15.5 points compared to a premium of 8.9 points earlier. Rollovers currently stand at 27 percent. On the other hand, Nifty Bank's futures added 1.1 percent in Open Interest with rollovers at 31.2 percent. Nifty 50's put-call ratio is now at 0.83 from 0.78 earlier.

Delta Corp, Indiabulls Housing Finance, GNFC, Metropolis Healthcare and PNB are out of the F&O ban list from today's session, while Escorts and Sun TV are back in the ban list. BHEL, India Cements, Hindustan Copper, Manappuram Finance, GMR Infra and RBL Bank continue to remain in the ban list.

Nifty 50 on the Call side for August 31 expiry:

For this Thursday's weekly and monthly expiry, the Nifty 50 call strikes between 19,300 and 19,400 have seen Open Interest addition. The 19,300 Call has seen maximum Open Interest addition. Additionally, the 19,800 call strike has also seen an addition of close to 40 lakh shares in Open Interest for this Thursday's expiry, a strike that's nearly 550 points away.

StrikeOI ChangePremium19,30083.08 Lakh Added72.8519,40045.71 Lakh Added38.219,80038.39 Lakh Added3.419,35034.8 Lakh Added53.15Nifty 50 on the Put side for August 31 expiry:

On the downside, the Nifty 50 put strikes between 19,000 to 19,400 have seen addition in Open Interest for this Thursday's expiry.

StrikeOI ChangePremium19,10023.03 Lakh Added39.2519,20020.13 Lakh Added69.1519,00019.02 Lakh Added2119,40017.43 Lakh Added181.25Lets take a look at the stocks that saw short covering on Friday, meaning an increase in price but decrease in Open Interest:

StockPrice ChangeOI ChangePiramal Enterprises1.73%-19.45%Sun TV3.79%-18.37%Bharti Airtel0.29%-13.75%Mahanagar Gas0.25%-13.00%Vodafone Idea8.81%-12.39%Here are the stocks which saw unwinding of long positions on Friday, meaning a decrease in both price and Open Interest:

StockPrice ChangeOI ChangeCan Fin Homes-1.41%-7.90%Cummins India-0.56%-7.89%Tata Communications-1.20%-7.75%ITC-1.60%-7.71%Wipro-1.19%-7.63%Here are the stocks to watch out for ahead of Monday's trading session:

What Do Global Cues Indicate?

US markets ended higher on Friday, as Wall Street cheered comments from Fed Chair Jerome Powell, that pointed towards stronger-than-expected economic growth.

The Dow Jones closed nearly 250 points higher, while the S&P 500 and Nasdaq gained 0.7 percent and 0.9 percent each respectively. Both these indices snapped a three-week losing streak.

However, it was a second straight weekly loss for the Dow Jones. Fed Chair Powell gave no clear indication at Jackson Hole as to where interest rates are headed.

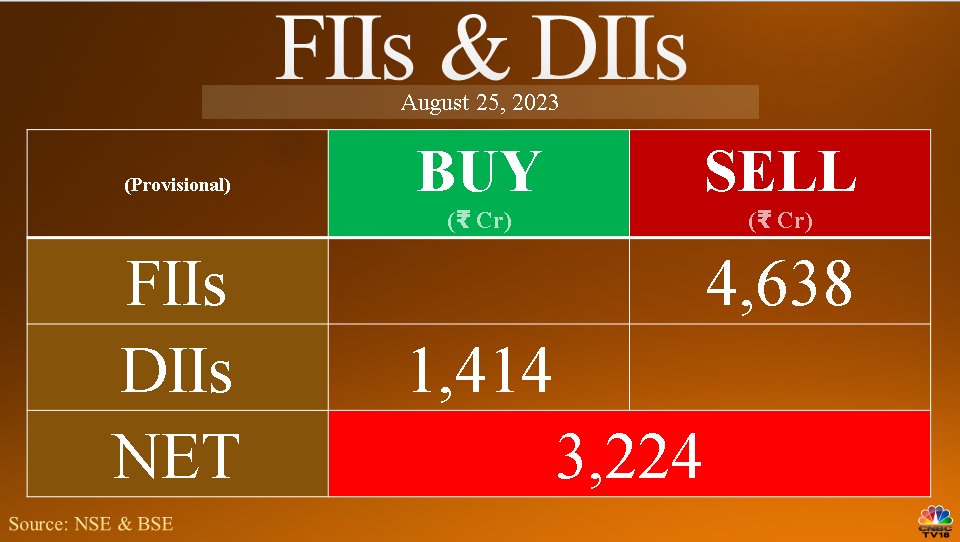

Foreign investors remained sellers in the market on Friday, while domestic investors were buyers. The numbers will also be skewed due to block deals in stocks like Paytm, Amber Enterprises and Uno Minda.

Rupak De of LKP Securities said that the Nifty 50 has declined to its 55-EMA support level and that the sentiment will stay bearish as long as it remains below 19,450 on the daily charts, which is the 21-DEMA. He further said that if the index falls below 19,240, it will fall towards levels of 19,000.

"Going ahead, a move below 19,200 might confirm a fresh breakdown from this support and then we might witness a fresh round of selling in the market," said Mehul Kothari of Anand Rathi. In such a scenario, the Nifty 50 may fall towards 19,000 - 18,800 but we expect the index to test its 200-DMA of 18,500, he added. This bearish setup will be negated only after the Nifty 50 closes above 19,600.

First Published: Aug 27, 2023 3:28 PM IST

Source link